Hi every one today I am

back with the summary of another book and that is ‘The only budgeting

book you’ll ever need’ How to

Save Money and Manage Your Finances with a Personal Budget Plan That Works for

You by TERE STOUFFER.

|

| The only budgeting book you’ll ever need |

I highly recommend everyone to read this book this book explains you dos and don’ts of different aspects like housing, investments, retirement etc. this will help you to make better choices. So lets get started.

Getting started with budgeting

Planning is bringing the future into present so that you can do

something about it now.

-

ALAN LAKEM

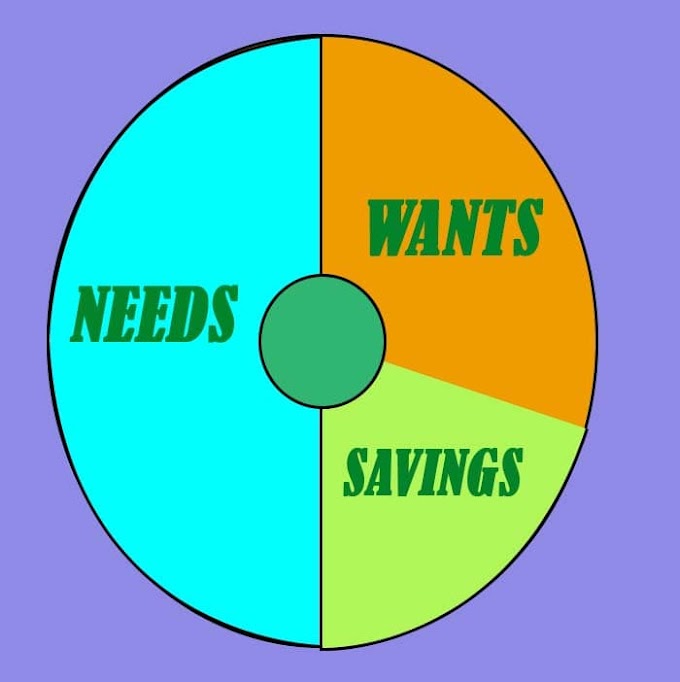

Budgeting is all about knowing what you have, where are you spending it and what can you do to achieve your dream. You just need few things to get started with budgeting

- Computer or if you like paper and pen

- Normal Microsoft excel or a designated software

- Your income and expense record

- And a quiet place

· What do you want?

First of all start by writing down your goal short term and long term. It differs depending on your age, lifestyle, condition you are in and many more. Once you have written down your goal think realistically about which goal are achievable. Everyone wants everything but the sad part is we can’t have it all, so set realistic goal with a deadline to them. it can be clearing your credit card debt, collecting money for your child’s higher education, buying new home, planning your retirement etc.

What do you have?

List down all your assets and incomes. Your source of income should be reliable which you know you will receive regularly. Don’t include something like lottery which you are not sure about.

Asset is something you own. If you have something on loan let’s taken for example you have your house on which you pay mortgage, determine the current market value of your house. it may be more or less than the price you bought it. Ask your mortgage company for the receipt that tells you the pay off amount. Subtract the pay off amount from the current market price that is the equity you have which definitely counts as asset. You can add something special like antique or other things if they have that worth.

|

| Getting started with budgeting |

What are you spending?

For tracking your expense start buy daily expense. Create a worksheet write all you’re daily spending in it. One thing to note is that while doing this do not reduce your spending just to make yourself happy, spend the amount you usually do. Now categorize your spending and then prioritize them. doing this will give you clear and realistic picture on where you can reduce your spending. Do the same for monthly expense just make sure, you don’t double calculate for stuff you already accounted in your daily expense.

What do you owe?

Write down all that you owe with the exact amount, interest rate, company name, additional fees, your monthly payment. It can include mortgage, student loan, home loan, car loan. Make plans to pay your debt with highest interest rate 1st. Your annual income should be greater than your annual financial obligations.

Points to remember

Don’t spend on stuffs you didn’t account in your budget, no matter how great the deal is.

Spend only on budgeted items.

Be prepared for unexpected expense, save money equivalent to your six month’s salary.

Goal and priorities will change with time so keep revisiting your goal and modify it accordingly.

Now I know that creating a budget and sticking to it is easier said than done. But remember the worst thing that can happen to you is ‘that you quit’. So start with your budgeting it will take some discipline, but things will improve. And you can always take break when you are tired.

Save money around house hold items.

|

| Sticking to your budget |

If you go for out for lunch because you are out of your home, may be office or college. Try bringing lunch from home.

Coupon can surely save you money, but only if you buy stuff that you would have bought anyways. Don’t buy stuff just because you have coupons for it. Same thing goes for discounts. So create a shopping list and don’t buy anything other than that.

Keep yourself informed about the cost of different products in shops in your areas, to find a good bargain. Your local news paper should do the job. Buy the product in quantity if its for sale, is non perishable, you can afford it and if you use the product regularly.

|

| Compare price of different shops |

One more way to save on vegetables is to have vegetable garden of your own. The only things required is some space it can be on ground or balcony in containers, seeds and good soil quality.

|

| Gardening |

You would have come across many companies that give you extended warranties on existing product you have warranty on. Most of the time its not worth it because

- Price of product is less or will decrease in few years

- In few years it will be out dated

- Repairing is inexpensive

· Extended warranties is useful only when

- You can afford to replace the product

- Price is significant

- Warranty is good deal

Always buy product of good quality. It doesn’t make sense to buy cheap quality and repair it again and again. Most people have misconception that good quality product are costly, it’s not always true. Similarly second hand product need not be of bad quality, just make sure it’s not damaged.

Don’t always follow the trend, things become really cheap when the trend is gone.

And last but not the least, transport has also become the major expense nowadays. Sometime using bicycle and carpooling instead of buying a car and paying for its maintenance and other bill sound like a good idea.

Pay your debt

Many people are surprised and shocked when all of their debt is combined and written in one place because the value is huge. If this condition seems familiar to you then there are few option that you can try to restructure your debt

- Credit counseling

- Debt

consolidation

- Selling some of your assets

· If your finding it difficult to make your monthly payment of your debt then debt restructuring is exactly what you need to do. Here the focus is to

- Increase your repayment schedule

- Combine your different payment into one smaller payment

- Try to get some of your debt forgiven

- Go for low interest rates

- And to never get into further debt

Go for credit counseling

It’s a free nonprofit service provided by some agencies where you are assigned a counselor. Which look at you debt, income, assets and other financials to provide alternative other than bankruptcy. Also this agencies conduct seminar on various financial topic which can help you build your knowledge.

Debt consolidation

|

| Debt consolidation |

The major obstacle in paying back your debt is not the principle amount but the huge interest. Debt consolidation is where all your debt are combined into low interest loan or debt and your repayment schedule is increased. This way you can avoid paying extra money and also it helps to repay your debt fast.

You can consolidate your debt on your own, may credit card company offers special form to simplify this process. But getting a counselor is best because he/ she will give you a tight budget to live by to pay your debt, or else you will just end up getting into more debt if you keep on going by your current budget.

Sell some assets

You will definitely find things in your house that has good value but are of no use to you now. Selling those things is a good option it can be anything clothing’s, furniture, equipments etc

- Advertize in local news paper

- Meet the reputable dealer in your area

- Sell it on some online website like OLX

- Auction you item either online or with service in your community

If you have many item but none is of great value try holding a tag sale. You can also do it with your neighbors.

If you own stock and bond and unless you holding it for some special purpose (like children education), sell them before doing it talk to your broker regarding the value and fee of the process.

Declaring bankruptcy

This the last and never to have option. I won’t go into the technicalities as it’s a huge topic in itself. I will write a separate article on this topic.

Savings and investing

With time you will realize that it’s of utmost importance that you have saving funds. There are many reasons for having savings retirement, college, emergencies or any other reason.

|

| IRA fund |

Government has made savings easier by giving tax break if you engage with them. Most popular among it is individual retirement account or IRA. Here you get tax break for contributing amount from your income to certain limit every year till the age of 591/2 into the plan. After that you can withdraw your money which is taxed but at lower level. Withdrawing money before 591/2 result in penalties. There are few variations of it

Roth IRA: - here you don’t get tax break on the amount contributed, but you are not taxed on the money you receive later.

SEP IRA : - simplified employee pension is set up by the employer for its employee where 20% of the your income is contributed to IRA. You can take the account with you when you change or leave the company.

Most company have their own employee benefit plan it can include

- Pension plans

- Profit sharing/ 401k/403b/457

- Simple IRA

- Employee stock owner ship plan

You can do savings and investment on you own. Opening a saving account and putting money aside for retirement is something which everyone can do. As far as investing is concerned you can invest on your own or if you don’t have the knowledge you can hire the stock broker to do it for you.

Merging your finances

Love is wonderful but don’t let it cover your finance. You and your life partner or future life partner need to discuss about your finance. Who among you is spender and who is saver, do your financial habit meet, if not how are you going to manage your finance after marriage. All this tough discussion need to be done before taking next step.

If you are not married you and your partner can choose to rent for 1 year doing this will allow you to determine how big room you need and which area to live in.

If you choose to merge your savings account as joint account one person can be made responsible to make all bill payments. If you choose to have separate account then you can share the bill proportionately among yourself according to your income.

Remember that at both of you would have to make compromise on different things to meet you common goal. Creating a joint budget will help you lot.

Baby on the way

You need to prepare and have budget discussion with your partner with your partner before having baby. Estimate expense of baby well before in advance, you can do this by no of ways

|

| Baby |

Interview other new parent in your neighbor. Doing this will help you to avoid mistake and bad decision taken by them. Also they can advise you for better alternative.

Read a good book related to babies. This will answer most of your question and also you may learn something new.

Visit online local store to check price of different baby product. Also find which product is necessary and which is extra.

Before going to shop for new product, determine what you already have

If you want any service like diaper, day care, babysitting or any other call in several; areas and compare their prices and choose which fit you.

Call you insurance company to find if there will be rise in your premium as new member will be joining your family.

You may think that you need big house because you have baby, but for 1 or 2 year you may be able to adjust in your current house as babies are small. If you have 2 bhk you may not need new house for several years or not at all. Check for prices before you decide to move in.

Now put all the above expense in a worksheet and get an idea of the expense you make encounter. Take the nine months gestation period to save for the expense by creating a budget.

Apart from day care centre and baby sitter you can choose between following options

- Grandparents

- If both you and your spouse are working one of you can change the shift so that one of you is always there to take care you baby

- One of you can leave the job, if you have savings.

House

Your house is going to be one of the or the only biggest purchase you will have in your life time. You can either rent or buy house. If you are paying hefty rent on house then buying a house should be considered, but if you are in debt or limited resources renting is the best option. There may be other reason to rent like if you are going to stay in the area for 2 years or less, real estate rate are high in the area, interest rates are high.

When saying about buying house very few people will be buying in full cash for most of the people it will be loan. So being aware of the factors that will affect the mortgage payment is important like length of mortgage, down payment, interest rates and also add PMI (private mortgage insurance) and escrow of monthly bill.

|

| House monthly payment |

Most bank will provide mortgage with span or either 15 or 30 years. If you go for 30 years plan you may have low monthly payment compared to 15 years plan but the total amount that will be going out of your pocket will be far greater than 15 years plan. Similarly you can save lot of money is you go for large down payment as you will be charged interest on the remaining money. Also when you have lower than 20% down payment you are charged additionally for escrow and PMI.

Interest rate are one of the major factor to think about when interest rates are low go for fixed interest loan. But when rates are high go for variable interest loan because rates will come down and when it does you can lock into low interest fixed loan.

You can buy/sell house without any professional estate agent, but if you are buying it for 1st time, in different city or in a short time span hiring a professional is recommended. While making an offer just look at the following points

- Selling your current house

- Clear inspection

- Title clear

- Including everything you list in offer

If your are planning to sell the house you live in as most people do you may have to do many repairs, paint it, replace fence and mail box any other thing required. You can price your house by yourself based on the [rice of house in your neighborhood or you can take help of realtor. When you receive an offer review it thoroughly and fell free to make counter offer if you need.

Ever heard of closing expense, it include many other expenses related to transferring property from you to your buyer. It include

- Mortgage points

- Loan origination fee

- Credit report

- Prepaid interest

- Escrow

- Title Insurance

- Recording fee

- Appraisal

- Survey

- Pest inspection

- Property taxes

- Insurance policy payment

To learn about these expenses in detail click here

After you have bought a new house create 3 budgets one for

considering your monthly payment 2nd when your monthly payment will

be lower and 3rd when you will be out of debt.

Most TV ads and society tell to live big but if you want solid

financial footing forget what they say and move to smaller home if you are not

able to make the monthly payment or want to be debt free fast. Moving to

smaller house will have some expense but it will save money on your monthly payments.

If you want to build your own house you can go for self build mortgage.

Finding money in your house

By this I mean that if your are paying high monthly payment you

can reduce it by refinancing your mortgage for low interest rate. You can

refinance your house and convert some equity into cash to pay for some of your

current debt.

But before applying for refinancing just make sure that you have

enough equity in your home and also you should have good retirement plan.

Because refinancing can lead to decrease in equity of your house.

You must have good credit score to qualify for refinancing, avoid the following to have good rating

- High debt-to-income ratio

- Late payments

- Too much credit

Home equity line of credit is where you apply for line of credit

against the equity you have in your house. Line of credit is like loan but instead

of cash or check you get checkbook from lender. You can use this to pay off

your high interest debt. But there are certain

advantages and disadvantages to it.

|

Advantages |

Disadvantages |

|

You can pay off debts with a

lower-rate loan |

Annual fees can be high |

|

Interest is probably tax deductible |

If

you fail to use it for pay your high interest debt you can end up having 2

mortgage |

|

Reduces

paper work and fees |

You must have enough equity available

in your |

|

You can plan ahead |

You lower the equity in your home |

|

|

You

must have the home in your name |

Vacation

and holiday

When you have made a budget and determined to follow it vacation

and holiday can ruin your determination unless you have planned and saved for

it too.

Cheaper vacation

For having fun you don’t necessarily need to go to Disney world or

some were expensive. You just need to do something that is different from your

daily routine, visit places you never visited before, it could be places nearby

say for example rock climbing at your nearby location (museum, park, zoos) can

be really adventures. You can choose to stay at hotel room with kitchen or if

you have campaigning equipment you can go that way or if the venue is nearby

you can choose to stay at home.

|

| Vacation and holiday |

To keep shopping under limit on vacation use traveler’s check or check card (debit card with a cap) instead of credit card. When buying present for your relative limit it to 1 or 2 but make sure its meaningful.

Create a budget including all your travel expense and others for

every individual travelling with you this will help you to have checked on your

spending. Have a fund solely dedicated to vacation and holiday instead of

relying on credit cards.

Saving for college

College is one of the biggest expense which you can’t leave, lets

understand different cost at college

Tuition fees: -it include all the administrative expense of the

college and it tends to be higher in case of private college compared to

government funded college. one way to reduce this cost is to go to complete

most of your education at community college and last two year when you have to

do specialization go for private college this way you will just have to pay for

2 years of high expenses.

Room and board: - room and food at college campus are expensive,

you can think of staying off campuss and sharing rental room with other

student.

Books: - take second hand books just make sure it not out dated.

Study abroad: - cost may be more or less depending upon the

location you want to go for studies.

Internship: - if your internship place is away from your home you

will have addition apartment expense

Transportation: - bringing your own car is always economical than

other alternative.

Miscellaneous expenses

How much you can save

Before starting saving have a talk with your spouse and kid, just make sure you are on same page about saving for your kids college fund. Here I will be just listing different alternative, detailed article will be made sooner.

- Government sponsored saving account

A.

Coverdell

Education Savings Accounts

B.

529s:

College Savings Plans

C.

Another

Kind of 529: Prepaid Tuition Plans

- Other Ways to Pay for College

A.

A

Fifteen-Year Home Mortgage

B.

Scholarships

and Grants

C.

Loans

- Work Study and Other Jobs

A.

Work

study

B.

Part-time

job

C.

Full-time

job

D.

Co-operative

education

E.

Internship

And last but not least create a budget for college expense.

Calculate how much money you can pull out each month and multiply by the no of

month left your kid to go to college. Compare the amount with today’s expense

and if your not satisfied look for more way to bring extra money into your

budget.

find more way to reduce your educational expense here.

Saving for retirement

The money that you will require in your retirement depends on your

goals and your circumstances during retirement. But one thing is for sure that

you will need to start saving for your retirement. While some me be clue less

about where to find the extra money to put in retirement account, reading this

section will definitely give good idea about where to get started. The secret

to having a hansome retirement fund is to start early.

If you eat outside twice a week, you may be able to save few

dollars by making the same meal at home. The difference may not seem

significant by added overtime will sum to a good amount.

Cut your shoes and clothing budget to half. If you’re comfortable

you can move smaller house than your current one doing this will lead to less

mortgage payment.

If you have habit of buying new car every 3 years, try twice as

long you currently use.

Instead of looking to cut expense you can also look at working some

extra hours at job or your own business.

Look at tax deferred way to save. (This has been covered in

savings and investment part)

If you are among people who are starting late, catch-up provision

is for you. Here you can contribute more

tax free income to government saving plan than your younger counter part.

You can also use your house to fund your retirement by selling the

house if it has appreciated in value. You can move to smaller house and the

additional amount get added to your retirement fund.

Reverse mortgage is also good option to look at. Here the bank buy

house from you and give your monthly payment.

How to survive unemployment

Always be ready for unexpected for something like recession, in

condition like this budgeting becomes more important not less.

|

| Unemployment |

If you lose your job the next thing to do is to assess how much money is still going to come in. you would generally have two options here.

- Severance

- Unemployment insurance

You very unlikely to get severance, even if you get one it would be too small. But you may get severance package where you will get job placement assistance. Whereas you are more likely to get unemployment benefit. If you are laid off, call or visit the state unemployment insurance agency and fill the claim. The amount and length of you claim depends on following factor

- How long you have been employed

- The state you live in

- General economic condition

If you get another job you benefit will stop. You can also go for self employment benefit if you Want to do business.

Cobra defined coverage

When someone looses job, the person is without health insurance

coverage. Consolidated Omnibus Budget Reconciliation Act (COBRA)

of 1985 help you to continue your health insurance coverage for 18 more months.

Once you lose your job you have 60 days to elect to continue your coverage. If

you fail to make the 1st payment during this period your coverage is

terminated.

Once you have secured you cobra coverage, you need to think about other insurance and those are

- Employer-Sponsored Insurance

- Insurance You’ve Been Paying For

When you are done with securing your insurance, you need to cut

all your unnecessary expense so that you can pay for your insurance policies.

At the same time you need to look for job as soon as possible.

Some laid off employs use this mishap to start with a career they

always wanted for example a small business. Have small plan for the time being,

start with business that have low overhead. If you already had big ambitious

plan of starting a consultancy firm, this may not be the appropriate time to

start that.

Other option that you can look for is

- Having one or two part time job

- You can try searching job in different area this might be easier said than done

After learning about creating budget and managing money it’s

important to apply it and stick to your budget no matter what.

|

| Sticking to your budget |

Conclusion

Everyone has a dream life that they want to achieve overtime, but

how many are able to get there? Not many. The main reason for this being lack

of financial skill. As Dave Ramsey

has correctly said “You must gain control over your money, or the lack of it will forever

control you!”.

So it’s very important for everyone to be good at managing their

money. And this book will surely help you to do so.

0 Comments