Why does stock price changes?

I am sure that you must have come across statements like “stock price of XYZ Company are falling” or “stock price of ABC Company are rising”. Have you ever wondered why this happened? Why stock price of some company rise, whereas that of other decrease? Who sets stock price? How does the stock price increase or decrease. How to know which share price will rise? What happens to companies when the stock price falls? How share price increase or decrease in India? What are the factors affecting stock price in the stock market? And many similar questions. In this article I will be discussing the above following questions.

|

The simple answer to the above questions is supply and demand. Lets understand this with an example, whenever there is heavy rain, flood or farmer protest or any such reason that effect the production of onion, the price of existing onion shoots up. Because the supply of onion decreases, but the demand remain as it is, as a result, there is less supply and more demand. And as the condition resumes to normal the supply of onion also increase as a result the prices decrease.

The same concept can be applied to a stock price of the company. There can be 2 situations,

- Buyers for a particular stock are more than the sellers. Here buyers are willing to give more price to buy the stocks as a result price rise.

- Sellers for a particular stock are more than the buyers. Here sellers are ready to sell a low price as a result the price decrease.

When there are problems going on in some XYZ company or some negative news comes out related to that. The number of buyers for that company decreases as a result the share price of that company decrease. Where as if there is a positive sentiment in the market than the price will rise.

In the stock market, there are N numbers of buyers and sellers which buy and sell due to different reason. Some base their decision on the fundamentals of the company, while some use news to make their decision, some people just speculate, like this there are many reasons. The supply and demand keeps on changing and hence the stock price fluctuates.

Lets discuss few reasons that affect stock price.

The fundamental of the company

This has a long term impact on the

stock price. It include

- Expansion plans

- Debt holding

- Promoter share pledging

- Profit/loss

- Management

- Industry related factors etc

Any company related news has direct impact on the stock price. The positive news will have rise in stock price and negative news will result in fall of share price. If the company is planning to open new plants, launch a new product or trying to enter into new market, noted high profits, announced dividend, merger or takeover, then in such cases company’s share price will grow.

On the other hand, if the debt holding of the company is increasing year on year, company has layed off large number of employees, recorded loss your on year , company involved in a scandal or scam, this is an indicative of a bad fundamentals, which will have a negative impact on stock price. Similarly, if the company has raised funds against promoters share in the company (promoter share pledging) this also has a negative impact on share price. Also, promoter decreasing its share in the company is perceived as promoter having low confidence in the company which is not good.

The technical indicators

This has a short term impact on the market. It include

- Liquidity of the shares

- News

- Charts and patterns

- Market overpriced or underpriced

The large cap company has high liquidity. Which means that, there is always demand for the share of such company. So it is easy to sell the stock of such company. On the other hand, in case of the small cap company, it’s comparatively difficult to sell stock of those companies, because many people are unaware of such company. This leads to decrease in share price of small cap company.

Although it is not possible to determine how exactly a particular news will be perceived by the investor or trader. But news like political situation, negotiations between countries or companies, product breakthroughs, mergers and acquisitions or any other news related to some event, does have an impact on the stock market.

Stocks historical performance also has significant impact on its future price that’s been charted and the pattern comes into play. When the stocks of a particular company are overpriced, it give rise to a bubble which will burst sooner or later and will result in fall of stock prices.

The best time to buy a stock is when it’s underpriced as the actual value will be noticed in the future and stock price will rise.

Macro and micro economic factors

This will have both short and long

term impacts.

- Socio-political stability

- Government policies

- Indian and world economy

- Demographics

- Inflation

- Other investment options

For any business to grow there should be stable political conditions there should be peace. Hence, whenever there is majority government formed stock market shows positive response. The stock market also shows a positive response to the business friendly government policies. Especially those sectors are dependent on government policies like infrastructure, power industry etc. are affected most.

Inflation has an inverse correlation with the valuation. Low inflation drives high result and vice versa. But on the other hand, deflation is bad for and it decreases the pricing power of the company which affects company’s profit.

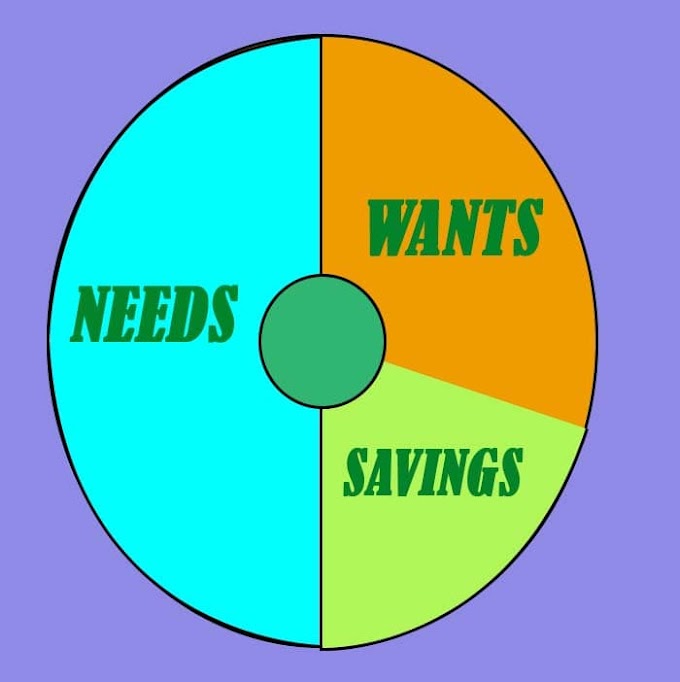

The middle age investors invest in the market to grow their wealth. Aged investors mostly remove their fund from stock market to meet their expense. So having a large number of middle age investors make stock price rise.

When there is negative sentiment in the market, people tend to divert their fund into other investment options like bonds, corporate or government, gold, real estate, fixed deposit etc. this affect the market in a negative manner. When the economy is rising it means that the output is more. This simply means the company is making profit and hence it will be able to give dividend. This makes its stock attractive and its price will rise.

Some other factors

- MPC interest rate

- GDP growth rate

The Monetary Policy Committee (MPC) of India

determine the rates of lending and borrowing in India. If the rate increase

then companies has to pay higher interest on the borrowed money. As a result

debt expense of the company increase which affect the profit and cash flow, and

hence their share price decrease.

GDP (gross domestic product) is the total

market value of goods and service produced in a country in a given specific

time. A strong GDP simply means that the businesses are experiencing good

profit and hence stock market move upward.

Human sentiments

This one is most unpredictable one which make is the most important. Its unpredictable because the way a particular news and information is interpreted differs from person to person. In stock market, there are lakhs and crores of people involved so it becomes important to understand the sentiment of the market. The human sentiment along with the external factor is the real driving force behind the fluctuation in stock market.

Conclusion

The stock price of any particular stock is decided by the demand and supply at that moment for that stock. There are many factors that affect the supply and demand, it can me fundamental or technical. Having knowledge of this factor will help us to understand the price action.

0 Comments