Hi everyone there, it won’t be wrong to assume on my part that you are in some kind of debt. As debt is one of the most common money mistake people make and you want debt free living. Getting out of debt is not too easy but not too hard either, just some analysis, prioritization and little discipline should improve your position. Being debt free means not to owe any money to anyone.

You should never get yourself into debt. The main focus should be

on living debt free life. Although you will come across many credit card

companies, investment bank, local banks and others in financial industry who

says that debt is good, but remember they earn by the interest you pay on money

you received as loan from them. So don’t believe them.

Here I will be giving you few tips to help you to get better at

debt management

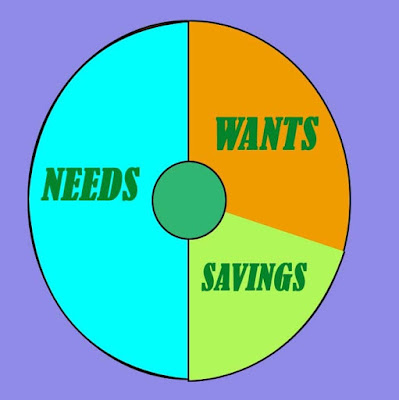

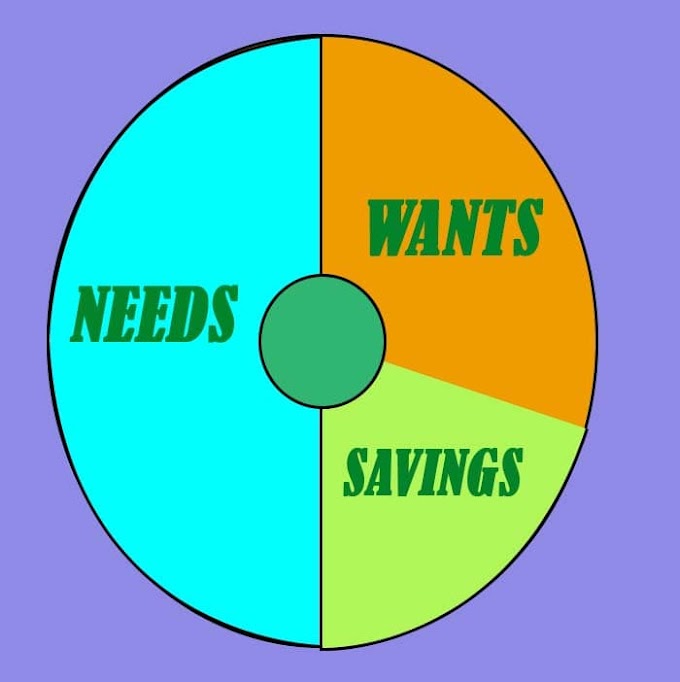

The 50 30 20 rule

The rule suggests spending 50% of you income on your need, 30% on

your want, and remaining 20% to be used as savings or toward debt repayment.

Following this rule will definitely make available more money for

your future goal.

Avoid Credits cards

This philosophy of buying now and paying later and trying to get everything now has taken over many people’s mind. When you buy things on cash you realize the expense, but with credit card you procrastinate and debt keep on increasing.

Keeping low credit card balance and timely paying your

credit card balance will improve you credit score.

Increase earning decrease spending

This one is self explanatory. If you have spare time in your schedule

try doing part time job and reduce you reduce your spending on your wants and

focus on needs. This helps you to get out of debt fast.

Analyze your debt

Determine how much you owe to whom. Find the principle

amount you owe and interest that you are paying on it.

You can decide to pay off your debt by different methods according

to your feasibility. Here are few popular methods

Live below your mean.

The point is to buy good that are below your purchasing power. If there is anything that you want to buy but is out of your purchasing power, save money for it and then buy it. Doing this will help you to remain debt free and give you peace of mind.

|

| debt free |

0 Comments