Factors affecting home loan interest rates and hence EMI

Everyone wants to have their own home, but you will rarely find someone with the potential to buy their dream house without a loan. Home loan plays a big role for the majority of people to buy their dream home. The answer to the question that “whether you will be able to afford a home loan” is it’s EMI i.e. Equated Monthly Installments. EMI helps to you to pay the principal amount along with its interest without any strain on your monthly budget.

The EMI

depends greatly on the interest rates on your loan. There are n numbers of

factors the affects the interest rates. While some of them may be fixed some

are variable.

List of major factors affecting EMI and interest rates

MCLR Rates

MCLR (marginal cost of funds based lending rate) is the lowest interest rate at which bank can lend money. Now there are other factor which affects MCLR rates too like

- Operating cost

- Marginal cost of funds

- Cash reserve ratio (CRR) and any negative carry on it

- Tenor premium

But let’s just

not go into the technical details for now

The MCLR method was introduced by the Reserve Bank of India on 1st April year 2016. The MCLR system replaced the base rate system that was introduced in the year 2010. If you bought loan before 1st April year 2016 then interest rate will depend on the based rate system.

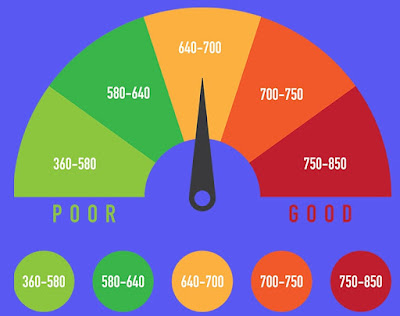

Credit score

Term period of the loan

Loan with long

time period like 30 years will have higher interest rate although EMI is low.

However, paying EMI for long period will result in you paying more money.

On the other

hand loan with short period like15 year will have lower interest rates, but

because you have to cover you principal amount and its interest in short period

your EMI will be more. Loan with a short term period will save you money

Interest types

You can loan have with

- Fixed rates: - Interest rates remain same throughout the term period of the loan

- Floating rates: - Interest rate may change, depending on the RBI norm it may increase or decrease

- Mixed interest rates: - Loan have fixed rate for specific initial year and then it changes to floating interest rate.

Loan to value ratio (LTV)

LTV is the percentage of the value of the property that is being

payed by loan amount. If the loan quantum is larger this will lead to higher

interest rates. Putting down a large down payment will help you to bring the

down the loan quantum and interest rates as well.

Location of the Property

Job profile

Individual with stable income like salaried professional, PSU

and government employees are considered to have low risk and hence are offered

lower interest rates. On the other hand self employed individual like small

business owner are considered of high risk and hence are offered higher

interest rates. Doctors and chartered accountants are considered low-risk among

the self-employed category.

0 Comments