How is the credit score calculated?

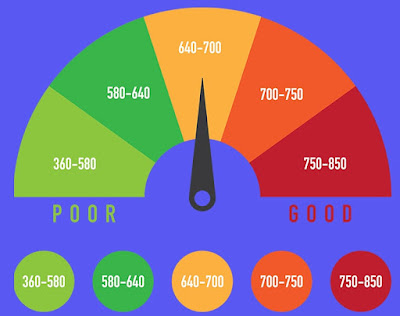

Credit score is a three digit number ranging from 300 to 850. It

is also known as FICO score as it was developed by the fair Issac Corporation.

This score defines the risk you possess to the lender. Higher the score less

risky you are to the lender.

There are 5 factors based on which this score is calculated. Let’s look at them one-by-one.

|

| factors affecting credit score |

Payment history

Your payment history of your bill accounts for the 35% of the

credit score. Here the point that is noted is that, how many days after the due

date you pay your bill and also how many resent payment have you missed.

If you make your payment on time before the due date, your score

will increase and that is good. Missing your payment will hurt your score.

Credit utilization

In simple word it means ‘how much you owe on your loan and credit

card’ and it accounts for 30% of the score. This is based on the amount you owe

compared to the credit you have available. If you owe large amount and have

utilized maximum of your credit card will decrease your credit score. On the

other hand, owing smaller amount will increase your score, if you pay it on

time.

If you have recently taken a loan, it will not have any payment

history as a result of which your credit score will decrease. However, if you

have a loan that is about get completed, it will have payment history and hence

will increase your score.

Length of your credit history

It accounts for 15% of the score. You must have come across many

people and books telling you to avoid credit card and stay away from debt. But

did you know, having short of no credit history can actually hurt your score.

Having a longer credit history of making timely payment will increase your

score.

Type of accounts

This

accounts for 10% of the score. To improve your credit score you should have a

mixture of different accounts like installment loans, home loans, and credit

and retail card.

Recent credit activity

This accounts for 10% of the score. If you have opened or applied

for many accounts, this suggests some kind of financial trouble as a result of

which your credit score may drop. On the other hand, if you have an old loan or

credit card that you are paying properly, then even after some payment trouble

your score will go up eventually.

If you want to know your credit score click here.

How is the cibil score calculated?

Cibil score is also a 3 digit number, but it ranges from 300-900. It is calculated by the TransUnion CIBIL credit limited (formerly credit information bureau [India] limited) which was incorporated according to the recommendation of the RBI’s Siddiqui Committee.

| Cibil score |

There are several factors taken into

consideration in calculating the cibil score out of which many factors are

similar to those mentioned above.

- Payment history

- Credit exposure / credit utilization

- Credit type and duration

- Other

The only point that I would like to add here is

that you should have a balance of both secured and unsecured loans. Having said

that, secured loans are more beneficial in improving your credit score.

When you apply for a loan or credit card the lender will look for your cibil report from the credit bureau. This is called hard inquiry. Too many of such inquiry will hurt your score. So you should apply for credit or loan wisely.

If you want to know your cibil score click here.

0 Comments